Avoiding Common Scams

Scams and crime have always been part of human existence. No sooner than a particular scam is thwarted, another takes its place. Technological advances make some scams easier to prevent, but at the same time makes other scams possible. It seems the good guys are always one step behind the bad guys - but there is good news: You can avoid being scammed by following a few simple tips.

A successful scam, no matter the type, requires that the victim 1) is not already aware of the scam and able to identify it, and 2) the victim is not expecting the scam. If either of those are true, the scam won't succeed. Since more scams exist than any one person can possibly be aware of, it's better to simply be on guard - all of the time.

This doesn't mean you need to lose sleep, however! Rather, assume those people or things you don't already trust shouldn't automatically be trusted. New people and new things should just warrant a slightly closer inspection - that's all. These tips also don't require you know scam-specifics, such as Microsoft doesn't cold-call or that the IRS only sends important communications via US Mail. These tips are much easier than that!

The #1 preventative tip is to ask yourself if the person/item/thing/action was expected. If you receive a communication you are concerned about, rather than calling the number or visiting the website provided in that communication, look up the phone number or website elsewhere and use that information to contact the company.

#2 - Generally be aware of anyone or anything requiring you make a hasty decision. "Call Immediately", "Offer Expires Shortly", and "Only Good While Supplies Last" are scare tactics used in making sales. A serious communication from your bank or the IRS, for instance, isn't a sales call and doesn't use that type of language.

#3 - When money is involved, take a moment to consider the protections you have if the transaction goes sour. For instance, let's say you purchase an item from an individual online - eBay, Craigslist, or maybe Etsy - and the seller wants you pay for the item using Gift Cards. Does this make sense? Think to yourself what happens - what recourse would you have - if the seller manipulates those gift card funds fraudulently? With a Credit Card, Apple Pay, Google Pay, Paypal, or various types of bank funds transfers, there are often times additional protections - some of which are provisions of law - to help prevent you from being scammed. If you are unsure that your transaction has protection, consult someone!

Examples

- If someone calls you unexpectedly claiming to be Microsoft, perhaps wanting to fix your computer, be suspicious - you're not expecting the call.

- It's not uncommon to receive mail warning you that a warranty is about to expire - again, be suspicious because you're not expecting this communication.

- If you receive email with an offer that's too good to be true - be on-guard, once again, because you weren't expecting the offer.

- You are presented an offer in which you cash checks, keeping a portion for profit, and forward the rest of the proceeds back to the entity offering this program. If you send money to an entity and later your bank determines the checks or monetary instruments you've deposited are not good, you'll owe the bank for the entire amount that was deposited regardless if you've sent or spent it.

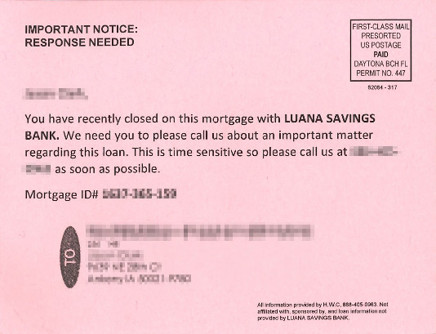

In 2018, one of our customers received this postcard. The red-flags here were that it was unexpected, conveys urgency, and the loan had been closed for several years. Unfortunately, and especially with the recent Credit Bureau data breaches, some of our customers have experienced an increase in communications or scams like this. Luana Savings Bank does not sell or provide customer information to 3rd parties for this purpose. This postcard clearly indicates, in the lower right-hand corner, that it is not affiliated with Luana Savings Bank:

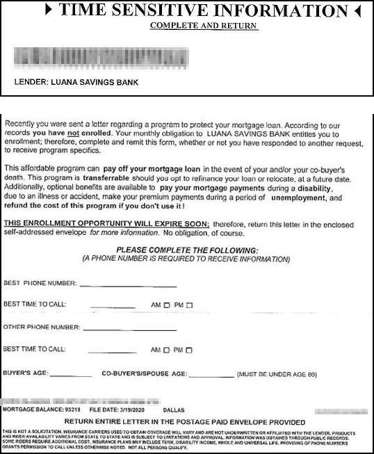

Another example seen by some of our customers in 2020: