We will be closed on Friday, July 4th in observance of Independence Day. We will be open on Saturday, July 5th from 8 am - 11 am.

The Cost of College

College Costs & Possible Debt

Presented by Carol Jensen, PhD, Vice President, Luana Savings Bank

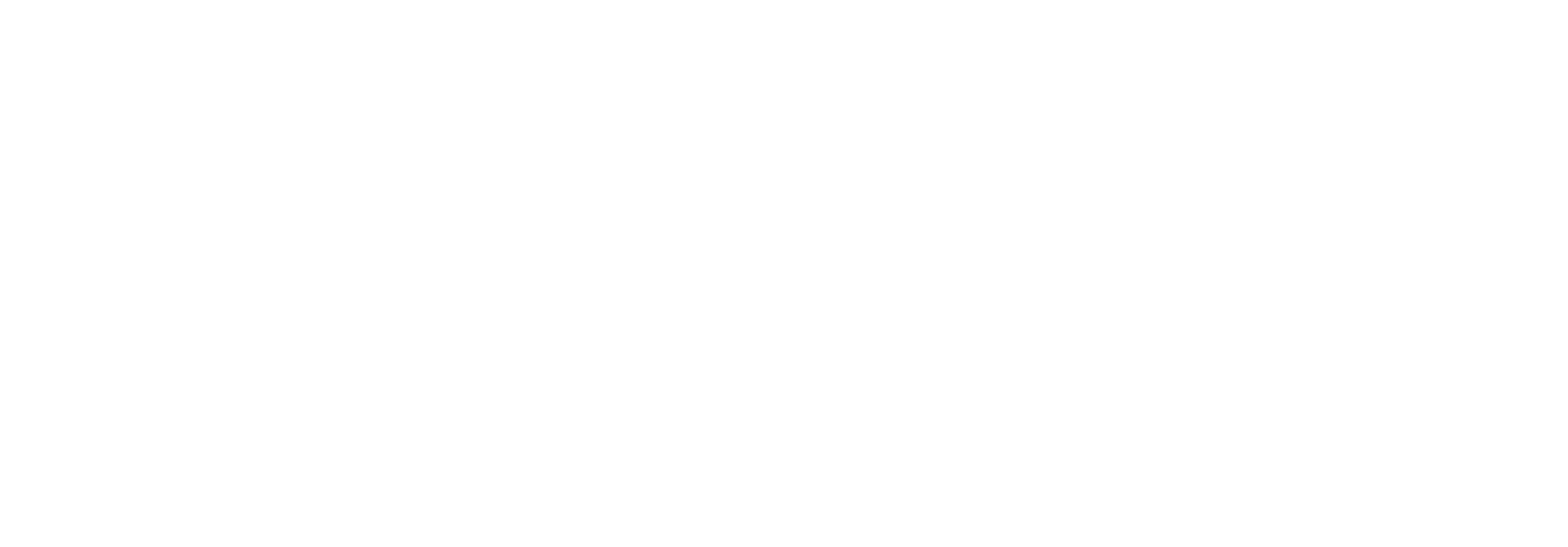

Do you know how much college will really cost, how much will need to be borrowed, and how long it will take to pay back college loan debt? In a 2014 survey, high school students identified some of their top fears before starting college as being homesick, gaining the 'Freshman 15', not fitting in, not being able to keep up in class, not knowing what to major in, and dreading dorm life. College costs and potential debt load didn’t even make the list, even though the estimated cost of attendance to the University of Iowa in 2015-2016 will be $21,010 per year for a resident or $40,796 yearly for non-residents!¹

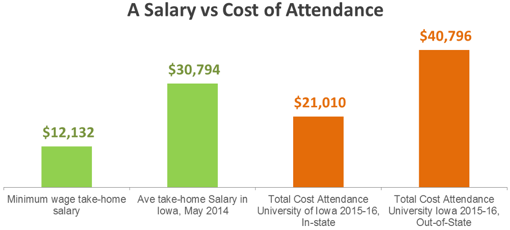

A 2012 Fidelity survey of families with children 18 and younger found that only 31% of parents have spoken with their children about total costs of college, future job opportunity, earnings potential, and possible debt load. Ron Leiber, New York Times Money Columnist, writes "Figuring out how much to pay for a college education is one of the biggest financial decisions people make in their lifetime, and parents often leave the final call to a 17-year-old."²

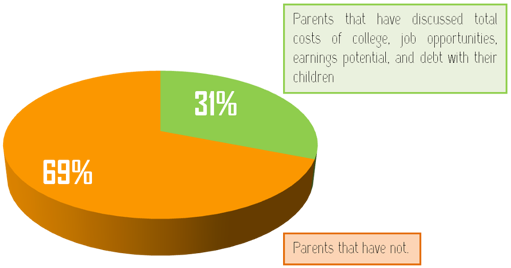

Nearly 44% of students have not yet earned a degree after attending college for six years; they have debt, but no degree. Making matters worse, of the Seniors who’ve graduated in the past 9 years, Iowa has ranked in the "Top 10 High-Debt States".³ In 2013, the average debt for a graduating senior was over $29,000. Remember that all debt is repaid with interest: the total paid on a $30,000 loan, at 7.10% interest⁴, for 10 years, would be $42,000 (or $350/month)!

It is unquestionable that, on average, a graduate with a Bachelor's degree will earn more than those with a 2-year degree, who in turn will earn more than a high school graduate. Proper decision making during college years can even influence retirement – whether a graduate will be able to retire at or before 62, or if they'll need to remain in the workforce until they are close to 70 years old. All of this comes down to planning: school choice, living a reasonable lifestyle and working during college, and understanding financial aid.

There is currently no "one stop shop" for students and families to rely on during the financial aid process. College graduates offer some of the best financial advice; if they could do it over again, they would have:

- Selected a major that would have led to a higher-paying job;

- Pursued more scholarships;

- Worked while in college;

- Started saving earlier.

For more information on how to receive scholarships, various types of financial aid (including the Free Application for Federal Student Aid or 'FAFSA') and a thorough examination of both, please pick up a copy of Carol's book, "College Financial Aid: Highlighting the Small Print of Student Loans". Carol may be reached at our Ossian branch.

Luana Savings Bank recommends that high school Juniors and Seniors prepare for college by identifying a field of study and obtaining real-world experience before leaving High School. College is not necessarily an ideal place to make these decisions because learning a subject and practicing it as a career are often very different.

Please check with your high school to determine how much time is excusable to job shadow. During summer, students should attempt to work full-time or as an intern in the desired field of study. Job shadowing isn't only about the job, but also the employees performing that job. Determine the education, degrees, and certifications that may be required. Ask about benefits and salaries, and ensure those are in-line with life goals after college.

Once a career and necessary education is identified, list colleges that will be able to provide that education within an appropriate budget. This budget will need to take into consideration how much is saved currently for college, how much part- or full-time work income will be available during college, and how much debt (in monthly payments) can be afforded after college given a projected salary. Lastly, don't forget about other expenses after college, like car and home loans, rent, moving expenses, etc.

¹Estimated Cost of Attendance, Living on Campus 2015-16. http://admissions.uiowa.edu/finances/estimated-costs-attendance

²"The Opposite of Spoiled: Raising Kids Who are Grounded, Generous, and Smart about Money"

³The Project on Student Debt. 2014 information has not yet been released. http://ticas.org/posd/home

⁴As of writing, this was the current PLUS/Parent PLUS loan rate

⁵1996-2006. 6-year delay in reporting is required. 4-year degree colleges were used in this study. 'Unaccounted' may represent those still studying or who’ve dropped out. https://nces.ed.gov/programs/digest/d13/tables/dt13_326.10.asp

⁶US Bureau of Labor Statistics. http://www.bls.gov/cps/minwage2012tbls.htm#6

⁷Iowa minimum wage at 7.25/hr. Assuming 40 hours per week, 52 weeks per year, two allowances, 2% 401k withholding, $90/mo healthcare purchase that is NOT provided by employer, and not taking into consideration taxes or other deductions or expenses. http://www.adp.com/tools-and-resources/calculators-and-tools/payroll-calculators/salary-paycheck-calculator.aspx