It's your tax dollars...do you care where it goes?

The issue of public funds and obligations to earn the best returns.

THE ISSUE

As Uncle Sam continues to collect from all taxpayers, it is important to know where our tax dollars are spent...or saved. We most commonly hear issues surrounding public spending, but what about the issue of public savings? Every state, county, city, school, and public entity that collects taxpayer dollars holds a certain amount of funds in bank depository accounts. It is simply the civic duty of our public servants to manage public money to best serve its constituents, therefore these funds should earn the best possible rate of return.

Luana Savings Bank has researched and found many of these public entities are not actively seeking out or are simply refusing to deposit funds within banks offering the best rates of return - a major public disservice - which can account for a significant loss of interest earnings from thousands to hundreds of thousands of dollars per year.

Simply put, would you rather deposit $1,000,000 of your personal money into an account earning .20% or .75% APY? Of course, you would choose the higher rate of return which equals approximately $5,500 of additional income per year per every 1mm invested. Now consider your local city or public school for example. Using the same example, compare this to $10,000,000 of public money where this equals $55,000 of additional income. There is no doubt every extra dollar earned could be put to instrumental use, whether it be for public facilities, equipment, salaries, or programs. The loss of this interest income is simply detrimental to constituents served by these entities. Politics, personal connections, or biases should always be set aside to ensure public tax dollars are properly managed and earning as much as possible.

LOCAL LOSSES OF INCOME

Luana Savings Bank is proud to be the depository of choice for a large number of public entities across Iowa, both large and small, being selected for offering top rates of return as well as our position as one of the largest, oldest, and most trusted community banks in the state. We truly appreciate this business and commend these entities for diligently making the best financial decisions for their constituents.

However, here are some examples of public entities losing money by not placing funds at top rates of return:

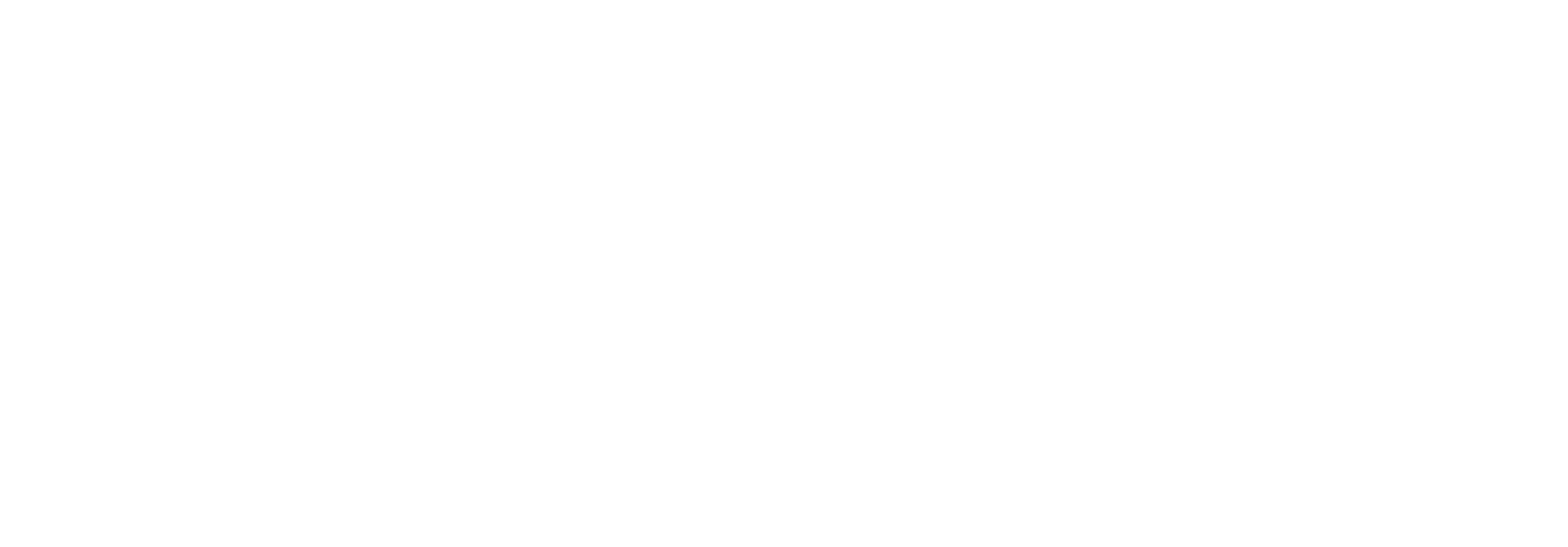

WINNESHIEK COUNTY, IOWA

Money Market accounts as of 10/15/21, provided by Winneshiek County.

*Luana Savings Bank is paying .75% for all Money Market Account amounts over $750,000*

LOSS OF INCOME: Totals approximately $58,377 per year when utilizing current accounts opposed to placing funds in Luana Savings Bank’s Money Market Account or 6 Month CD, both paying .75% APY. What could Winneshiek County, Iowa do with an extra $58,377?

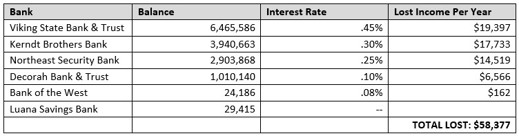

NORTHEAST IOWA COMMUNITY COLLEGE (NICC), IOWA

Business Checking, Money Market, and Certificate of Deposit accounts as of 10/8/21, provided by NICC.

*Luana Savings Bank is paying .75% for all Money Market Account amounts over $750,000*

LOSS OF INCOME: Totals approximately $296,098 per year when utilizing current accounts opposed to placing funds in Luana Savings Bank’s Money Market Account or 6 Month CD, both paying .75% APY. What could NICC do with an extra $296,098?

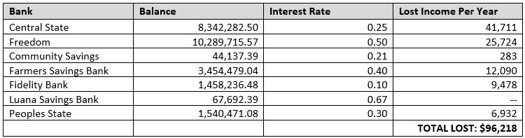

CLAYTON COUNTY, IOWA

Money Market accounts as of 9/30/21, provided by Clayton County.

*Luana Savings Bank is paying .75% for all Money Market Account amounts over $750,000*

LOSS OF INCOME: Totals approximately $96,218 per year when utilizing current accounts opposed to placing funds in Luana Savings Bank’s Money Market Account or 6 Month CD, both paying .75% APY. What could Clayton County, Iowa do with an extra $96,218?

BIDDING: A BETTER SYSTEM

The examples above show how some entities continue to spread funds around to multiple depositories, yet hardly earn any rate of return. Not asking banks to compete for these types of public deposits is outdated and antiquated. Many major public entities have gone to a bidding system where banks are asked to submit their best rate (or bid) on a certain deposit term or account type. The highest bidder simply gets the deposits. Depending on the competitive nature of the bidding banks, this might mean an entity utilizes only one, two, or far fewer banks. It is perfectly acceptable to place all funds within one depository because there is zero risk to this type of money. A bidding system simply ensures the strongest competition and highest returns on taxpayer dollars. Banks can and should pay a premium for these large scale deposits, where it is clear many banks are taking advantage of public funds by paying low returns.

SAFETY OF PUBLIC FUNDS

Public funds have numerous protections in place, so there is absolutely no reason for public deposits to be spread among depositories who may be paying very little returns. There is simply ZERO risk to public funds. In addition to federal deposit insurance, public deposits are secured by collateral pledged by banks and further protected by assessments paid by banks if collateral is insufficient to cover losses. View the State Treasurer of Iowa Website for more information on the Protection of Public Deposits.

WHAT CAN YOU DO?

Every taxpayer has the right to call upon public entities to request public information as outlined in the above examples: a breakdown of public funds such as depository, dollar amounts, and rate of return. Candid conversations must be had with these entities, especially the supervisory manager of the entities’ public funds, to find out why the best rate of return isn’t being utilized if that is the case. Further, taxpayers must demand funds be moved to depositories that best serve the entity and its constituents.