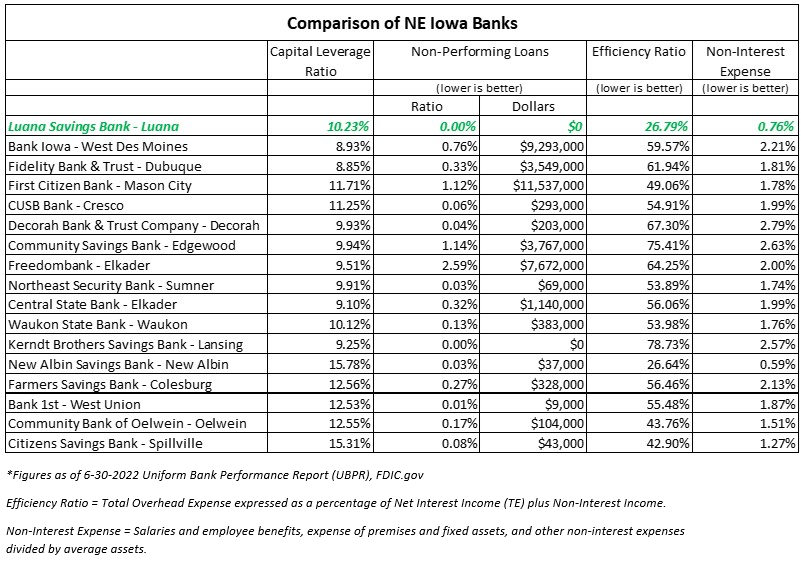

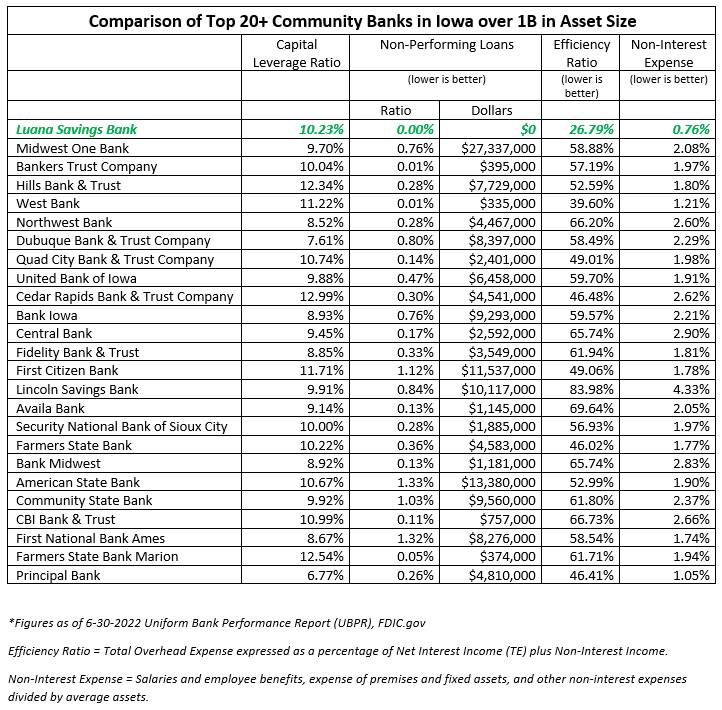

Luana Savings Bank continues to maintain outstanding Efficiency Performance compared to 16 other banks with offices in Northeast Iowa. Only one other bank matches this outstanding performance. Luana Savings Bank will continue working vigorously to maintain this performance and pass our efficiency savings along to our loyal customers.

Check out the highlights below:

Capital

Capital Leverage Ratios at Luana Savings Bank continue to increase, up to 10.23% (6/30/22) from 10.04% (3/31/22). The bank's ratio is strong for its size and ranks well among Northeast Iowa banks. For Luana Savings Bank, capital availability is unlimited and capital formation is a strength.

Non-Performing Loans

Luana Savings Bank continues to dominate all competitors in loan administration, boasting non-performing loans at -0- for the 2nd consecutive quarter. This exceptional record demonstrates rock solid underwriting, credit analysis, and loan review by an outstanding lending team. This metric has trended near -0- for decades and is unheard of within the industry, particularly considering Luana Savings Bank has grown its loan portfolio on average over 10% each of the past 30 years.

Efficiency Ratio & Non-Interest Expense

Luana Savings Bank’s low ratios in these categories continue to be major components of its success. Luana Savings Bank boasts a competitive advantage of 3.5x among Northeast Iowa banks in this category. It is often asked how Luana Savings Bank can pay top deposit rates state- and nationwide. Being the best in efficiency and non-interest expense allows the bank to pass these benefits onto customers via great deposit rates, but also allows Luana Savings Bank to compete against the biggest banks and credit unions in its market areas for large loans with favorable interest rates.