Performance Update as of 9-30-22

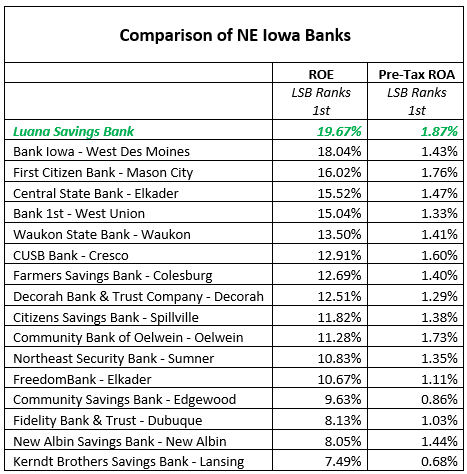

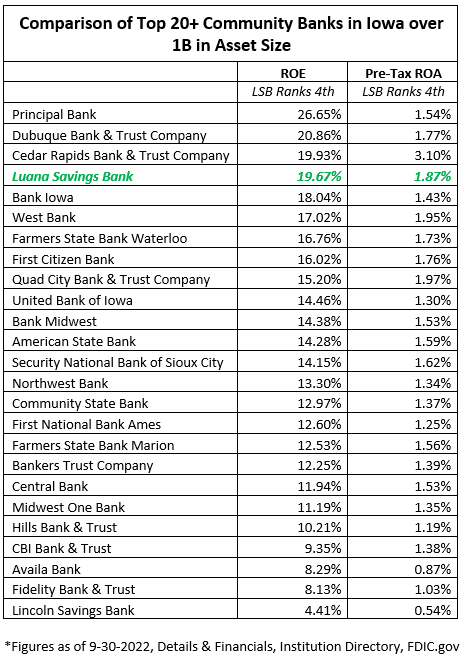

Luana Savings Bank continues to perform at the highest levels of the banking industry in Iowa. Luana Savings Bank ranks #1 in both ROE and ROA among Northeast Iowa banks and #4 in both ROE and ROA among Iowa banks over 1 billion dollars in asset size.

What ROE, ROA, and Efficiency Ratios Mean for Banks

ROE and ROA are two key measurements showing the success of a bank’s operations.

A high ROE shows how effectively a bank is taking advantage of its base of equity or capital. ROE also shows how efficiently a bank is operated which is a huge contributor to the success of this ratio. A high ROA shows how effectively a bank is creating earnings on its base of assets and managing the overall size of the institution.

Luana Savings Bank continues to put quality and profitable assets on its books and therefore the bank’s stellar ROE & ROA will continue to shine compared to its peer group. This allows Luana Savings Bank to continue to pay superior money market and certificate of deposit rates to customers while aggressively competing for quality assets. In turn, this propels higher ROE and ROA ratios for Luana Savings Bank. Depositors will be rewarded with great rates of return while having confidence in the performance, safety, and soundness of Luana Savings Bank.

ROE, ROA, and Efficiency Ratio Defined

Return on Equity (ROE): Annualized bank net income as a percent of average total equity on a consolidated basis.

Pre-Tax Return on Assets (ROA): Annualized pre-tax income as a percent of average total assets.

*Figures as of 9-30-2022, Details & Financials, Institution Directory, Uniform Bank Performance Report (UBPR), FDIC.gov