We will be closed on Friday, July 4th in observance of Independence Day. We will be open on Saturday, July 5th from 8 am - 11 am.

Understanding Your Credit Score

Consumer Credit

What is Credit and Credit Worthiness?

Consumer Credit, in the financial industry, refers to money provided to an individual in lieu of payment. Credit is used most commonly to purchase items that cost more than an individual typically is able to afford in a single cash transaction (like a vehicle or property). Credit is also commonly used as a convenience (like a credit or store card).

Credit Worthiness is a measure of how much money an individual is able to borrow while still being able to reliably pay back the debt later in time. Financial Institutions typically use one or more of three main national Credit Reporting Bureaus to obtain credit worthiness history/ratings before extending credit to a consumer. Using a Bureau(s) can ensure higher accuracy in calculating credit worthiness as the Bureaus typically track a larger set of data among many other reporting financial institutions.

How Credit Scores are Calculated

A Credit Score is a mathematically calculated representation of an individual's credit worthiness at a point in time. There are several ways to calculate credit scores using varying criteria; several organizations offer differing credit score products.

Credit Scores most commonly takes into account the following information:

- Previous Credit History, including Defaults, Settlements, Bankruptcy, etc

- Payment History - If you're making payments on-time

- How much Credit you have currently been extended, and what percentage is used

- Number of and Types of Credit (Auto, Real Estate, Credit/Store Cards, etc)

- How long your credit history goes back in time

- How often you apply for and are granted additional credit

Credit scores may also be based on criteria including Income Level, Job Type, Local Community and Economy statistics, Utility costs, Bank Account Balances, and publicly available information including that obtained from Social Networks, etc.

Improving Your Credit Score Short-Term

- Obtain a credit report from each of the three main Credit Reporting Bureaus.

- Report any issues in your credit report, specifically accounts you didn't open, credit inquiries performed by third parties that you are not aware of or did not approve, and payments you made on time that show up as late.

- Draft letters to any creditors (using addresses provided in the report) that haven't updated a significantly [lower] current balance in your report, asking for this update like if you paid a card/loan off one or two months ago but don't see this updated in the report).

Improving Your Credit Score Long-Term

Unfortunately, improving a credit score significantly usually takes time. Some information, such as Bankruptcies, may remain on your report for as long as 7 to 10 years. However, with a little effort over several months or years, credit scores will improve!

The best steps to take often include:

- Make payments on time. If a minimum payment cannot be made in full or on time, contact the creditor to see if there is a solution that won't impact your credit report or score negatively. Never skip payments or pay less than the minimum amount required without contacting the creditor beforehand.

- Pay off debt including Credit cards and keep balances as low as possible.

- Avoid settling debt or taxes as this may affect your credit report or score negatively

- Close unused store or credit card accounts

- If you have excessive numbers of store or credit card accounts, consider closing all but a handful

- Refrain from opening new credit and store card accounts more often than required

In addition, review your free credit report(s) yearly and report any anomalies, specifically looking for accounts you didn't open, hard inquiries that you did not know of or approve, and payments you made on time that show up as late.

Protecting Your Credit from Identity Theft

Identity Theft occurs when a criminal uses your private information, including Social Security Number and Birthdate, to fraudulently: open a line of credit such as a credit card or loan in your name, make a purchase, sign up for a utility, or gain employment, etc. One of the easiest ways to help prevent Identity Theft is to place a Security Freeze on your credit file with each of the three main Credit Reporting Bureaus and the fourth, smaller bureau, Innovis. A Security Freeze is a provision of Federal Law, and as of September 18, 2018, are free of charge.

When you place a Security Freeze, your credit report is 'frozen' and not available to many financial institutions that require a copy of your credit report before issuing credit or a loan. Down the road if you legitimately require credit, ask your financial institution which bureaus they will be using to obtain your credit history, and temporarily lift your Security Freeze at each bureau. Some credit bureaus offer an online form to easily set-up and manage Security Freezes.

Security Freezes also help to promote safety by blocking sites or services that rely on knowledge-based authentication (‘KBA’), like the IRS (in effect helping prevent some tax return fraud) and Social Security Administration (preventing someone else from registering for your Social Security benefits). KBA questions may be similar to: have you ever had a loan of a certain type/amount/date, name of a creditor, previous or current address or phone number, name of a utility you use, etc. If you recall answering those types of questions in the past, chances are they were authenticated against your credit report, and if your report was frozen may prevent criminals with your personal information from accessing the site or service on which those KBA's appeared.

Placing and removing Security Freezes may become prohibitive if you (or your business) routinely rely on establishing credit. Contact a Credit Bureau before placing a Security Freeze on your file to make sure that you fully understand the benefits and drawbacks.

Another way to protect your credit is to check your credit report from each of the three main Credit Reporting Bureaus often - even if you have a Security Freeze on your credit file(s). Be on the look-out for, and report to the respective reporting bureau ANY item you find in the report that is incorrect.

See Also: Identity Theft

Free Credit Reports

You are entitled to free credit reports (not score) from each of the three main Credit Reporting Bureaus weekly (as of October 2023). All three reports do not have be requested at once. The following website is the only free service authorized by these Credit Reporting Bureaus; they warn consumers to never provide personal information to any other company or person for requesting free annual credit reports under the FACT Act. Using any other website or company to obtain your free annual credit report(s) may expose you to unnecessary risk, fraud, or fees.

https://www.annualcreditreport.com

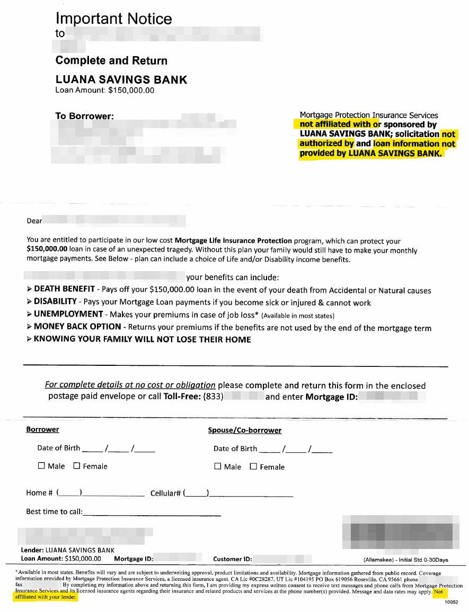

Example solicitation: